API3

API3 is a collaborative project to deliver traditional API services to smart contract platforms in a decentralized and trust-minimized way. Its primary focus is to bring cryptocurrency price data to smart contracts in a secure and reliable manner. API3 price feeds have OEV (Oracle Extractable Value) built in to the price feeds by default, this allows dapps to monetize the update of the price feeds they are using. It is governed by a decentralized autonomous organization (DAO).

Read more about how The API3 DAO works. Click here

Using dAPIs - API3 datafeeds

dAPIs are continuously updated streams of offchain cryptocurrency price data. They can power various decentralized applications such as DeFi lending, synthetic assets, stablecoins, derivatives, NFTs and more.

The data feeds are continuously updated by first party oracles using signed data. Dapp owners can read the onchain value of any dAPI in real-time.

Due to being composed of first-party data feeds, dAPIs offer security, transparency, cost-efficiency and scalability in a turn-key package.

Apart from relying on deviation threshold and heartbeat configuration updates, unlike traditional data feeds, OEV Network enables dapps using dAPIs to auction off the right to update the data feeds to searcher bots. Searcher bots can bid for price updates through the OEV Network to update the data feeds. All the OEV proceeds go back to the dapp.

The API3 Market enables users to connect to a dAPI and access the associated data feed services.

Learn more about how dAPIs work.

Subscribe to dAPIs

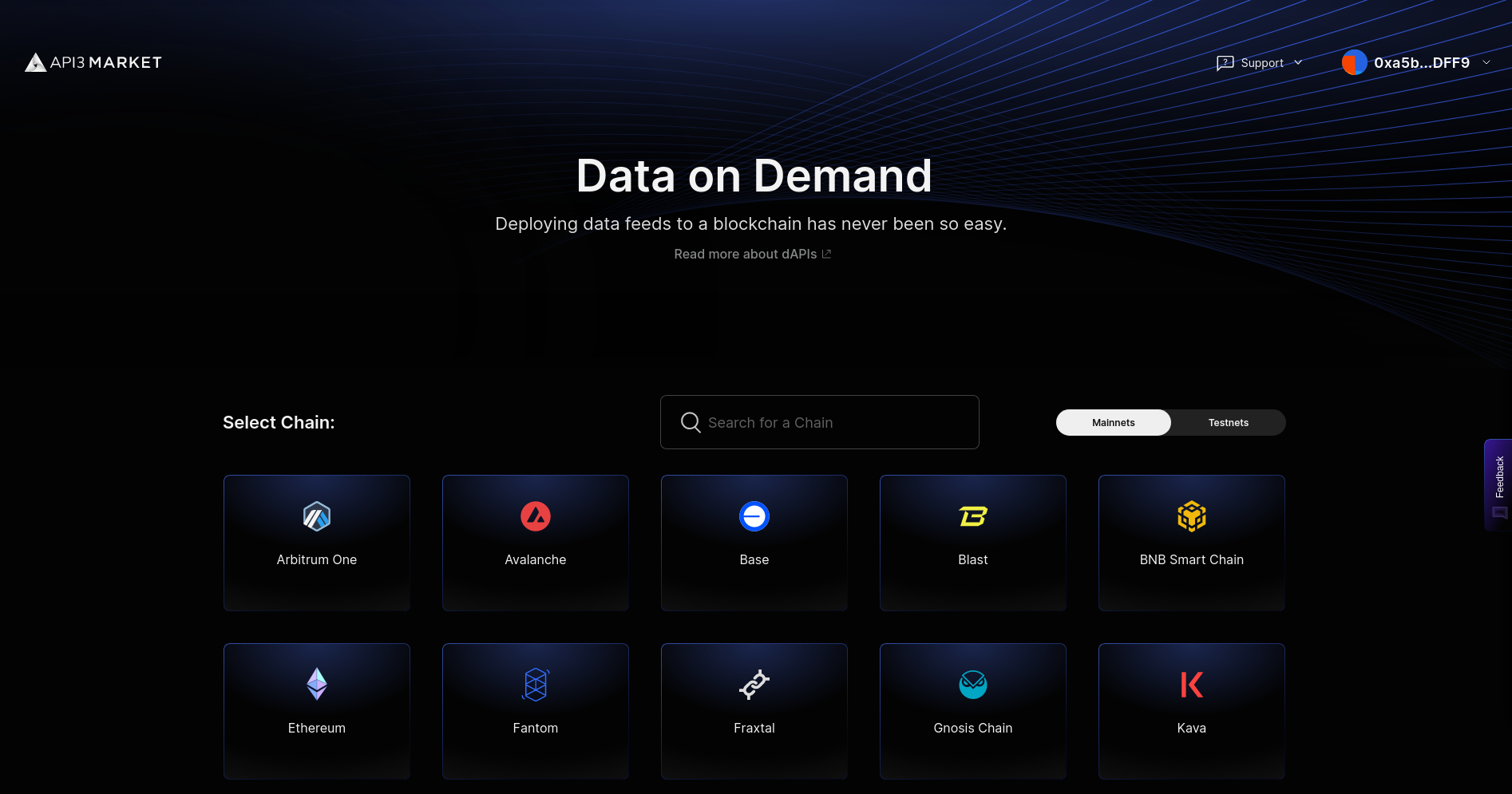

The API3 Market lets users access dAPIs on both Lumia Mainnet and testnet.

Explore, select and configure your dAPI

The API3 Market provides a list of all the dAPIs available across multiple chains including testnets. You can filter the list by mainnet or testnet chains. After selecting the chain, you can search for a specific dAPI by name. Once selected, you will land on the details page (eg ETH/USD on Lumia Testnet) where you can find more information about the dAPI.

The current supported configurations for dAPIs are:

Deviation

Heartbeat

0.25%

24 hours

0.5%

24 hours

1%

24 hours

5%

24 hours

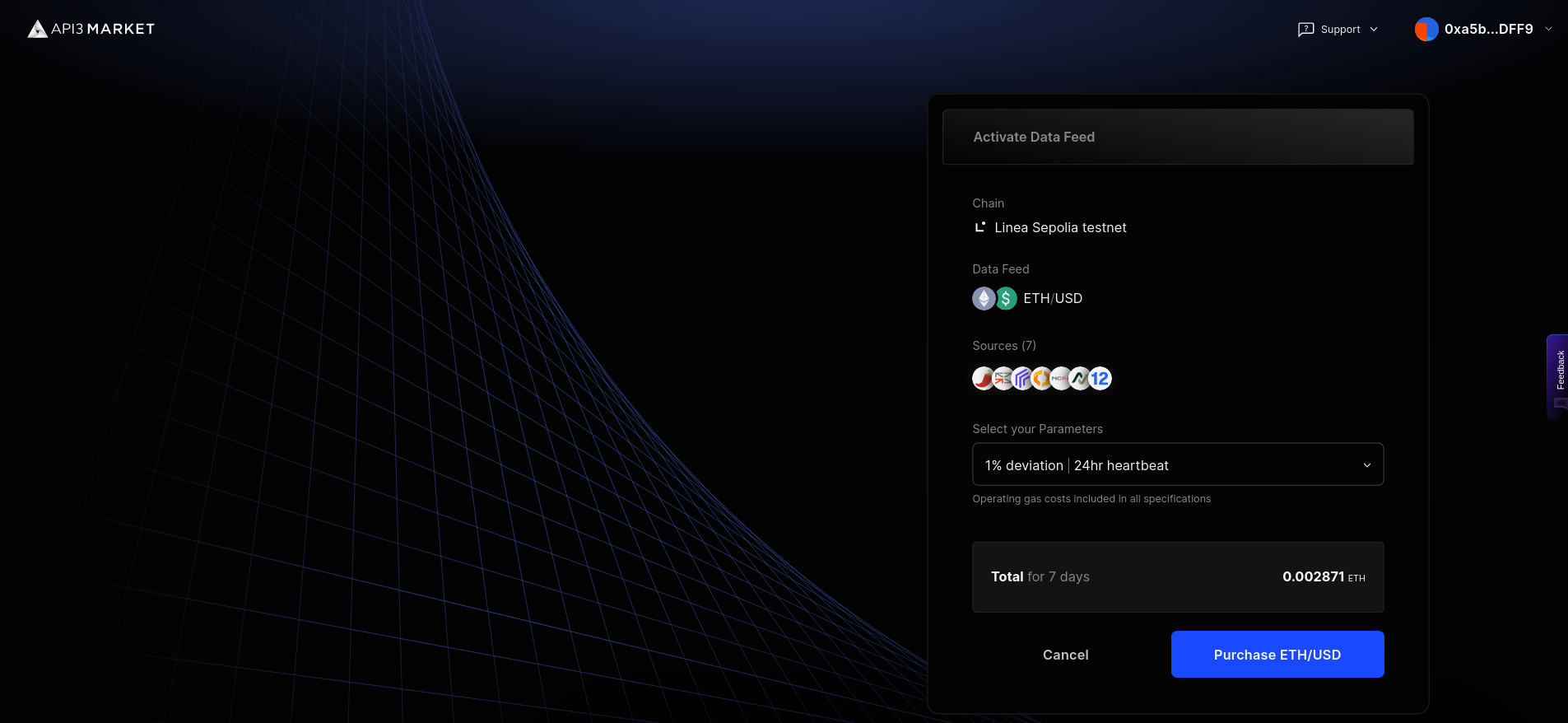

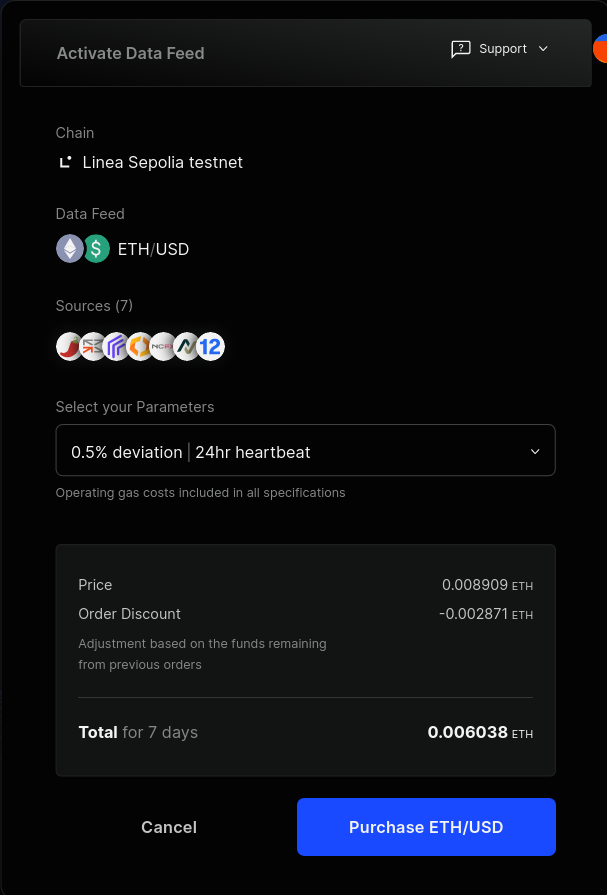

Activate your dAPI

If a dAPI is already activated, make sure to check the expiration date and update parameters. You can update the parameters and extend the subscription by purchasing a new configuration.

After selecting the dAPI and the configuration, you will be presented with an option to purchase the dAPI and activate it. Make sure to check the time and amount of the subscription. If everything looks good, click "Purchase".

You can then connect your wallet and confirm the transaction. Once it's confirmed, you will be able to see the updated configuration for the dAPI.

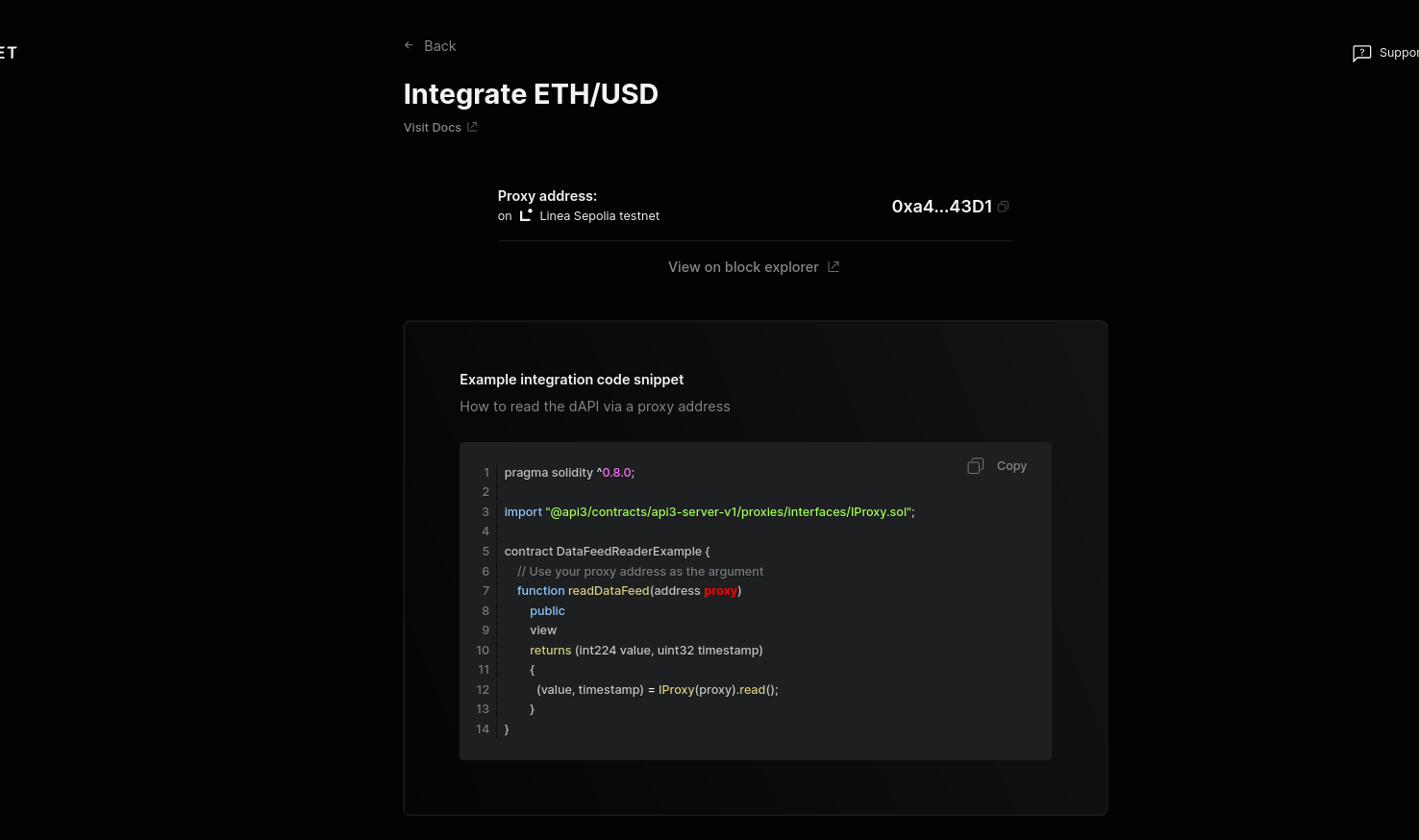

Get the proxy address

Once you are done configuring and activating the dAPI, you can now integrate it. To do so, click on the "Integrate" button on the dAPI details page.

You can now see the deployed proxy contract address. You can now use this to read from the configured dAPI.

Read from a dAPI

Here's an example of a basic contract that reads from a dAPI.

setProxyAddress()is used to set the address of the dAPI Proxy Contract.readDataFeed()is a view function that returns the latest price of the set dAPI.

Resources

Here are some additional developer resources:

Last updated

Was this helpful?